capital gains tax increase 2021 uk

12300-Amount on which CGT Charged. However this could mean implications for far more people with some.

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capital gains tax in the United Kingdom is a tax levied on capital gains.

. 0400 Sun Oct 24 2021. 0703 Thu Feb 11 2021 UPDATED. 5Live caller slams government waste and.

If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners to increase the extent to which these are subject to income tax. Capital Gains Tax CGT has been one of the levies discussed - a tax on the profit of. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to.

The capital gains tax allowance in 2022-23 is 12300 the same as it was in 2021-22. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. Taxes united-kingdom capital-gains-tax capital-gain.

0754 Fri Oct 29 2021 UPDATED. If your assets are owned jointly with another person you can use both of your allowances which can effectively double the amount you can make before CGT is due. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely.

0755 Fri Oct 29 2021. First published on Tue 26 Oct 2021 1100 EDT. 1115 Thu Feb 11.

The government has shelved proposals to raise capital gains tax but has agreed to make technical tweaks to simplify the process. CGT payable by higher rate taxpayers. Who claimed that the new rules would increase the CGT liability of small businesses and discourage entrepreneurship in the UK.

As you rightly highlight in your first report these reforms would involve a number of wider policy. 1754 for property 8770 for other assets. 2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019.

87700-CGT payable by basic rate taxpayers. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. This is the amount of profit you can make from an asset this tax year before any tax is payable.

Alongside maintaining the Lifetime Allowance and Capital Gains Tax it is estimated the Treasury will raise some 204billion. Legislation will be introduced in Finance Bill 2016 to amend subsections 4 2 3 4 and 5 of TCGA to reduce the 18 and 28. Capital gains tax rates for 2022-23 and 2021-22 If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax.

CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in yesterdays Budget an expert has warned. There may well be some form of change to Capital Gains Tax rates but the annual exemptions will stay at 12300 for individuals and 6150 for most trusts. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four.

OTS proposals suggested bringing Capital Gains Tax in line with Income Tax currently charged at a basic rate of 20 percent and rising to 40 percent for higher rate taxpayers. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year. CAPITAL GAINS TAX is likely to increase and there could be major implications for some Britons an expert has warned ahead of the Chancellor Rishi Sunaks Budget.

The government could raise an extra 16bn a year if the low tax rates on profits from shares and property were increased. 15786 for property 8770 for other assets. Rishi Sunaks budget in March 2021 froze the allowance at this level until 202526.

We Are Available 24 7. The higher rate threshold the Personal Allowance added to the basic rate limit will increase to 50270 for 2021 to 2022. Once again no change to CGT rates was announced which actually came as no surprise.

Tue 26 Oct 2021 1157 EDT. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015. Theodore Lowe Ap 867-859 Sit Rd Azusa New York.

In a letter to the Officer of Tax Simplification conservative MP Lucy Frazer on behalf of the Treasury said. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. First deduct the Capital Gains tax-free allowance from your taxable gain.

Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. Potential Increase in Tax. As announced at Budget the government will introduce legislation in Finance Bill 2021 that maintains the current Capital Gains Tax annual exempt amount at its present level of.

The annual exempt amount could be reduced from 12300 per annum to between 2000 and 4000 a dramatic. Or could the tax rate be retroactively applied to the 202122 tax year.

Capital Gains Tax What It Is How It Works What To Avoid

Difference Between Income Tax And Capital Gains Tax Difference Between

10 Things You Need To Know To Avoid Capital Gains Tax On Property

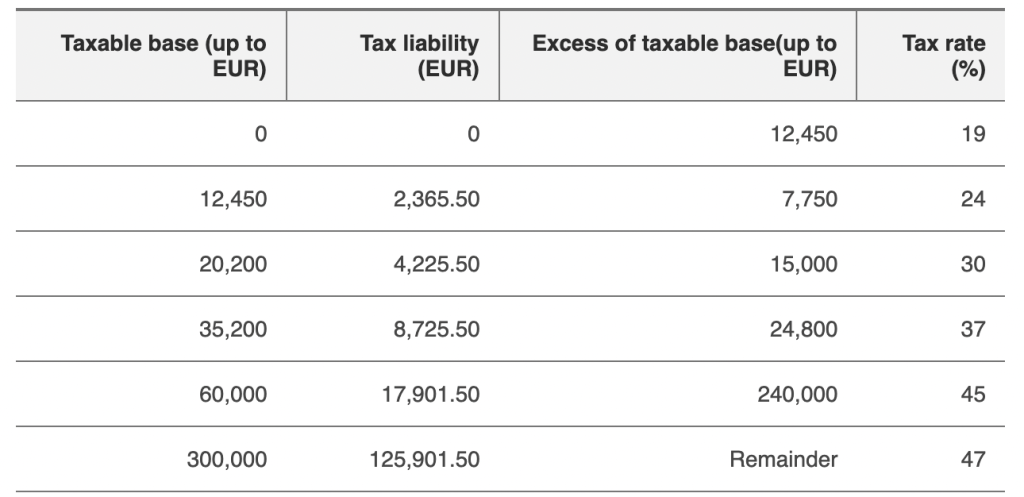

Property Taxes In Spain 9 Taxes You Have To Know

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

A Complete Guide To Capital Gains Tax Cgt In Australia

What Are Capital Gains Tax Rates In Uk Taxscouts

Difference Between Income Tax And Capital Gains Tax Difference Between

Selling An Inherited Property And Capital Gains Tax Yopa Homeowners Hub

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Portugal Capital Gains Tax When Are You Liable And How Much Do You Pay

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax On Separation Low Incomes Tax Reform Group